How family enterprises can navigate adversity and build organizational fortitude

Fire, floods, relocation, and a pandemic couldn’t sink Formans, the family-run smoked salmon supplier. Here’s how they stayed afloat....

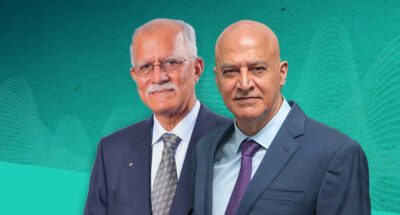

by Alfredo De Massis, Josh Wei-Jun Hsueh, Luis Gomez-Mejia Published May 28, 2024 in Family business • 5 min read

Some family firms exhibit a preference for formal corporate social responsibility (CSR) strategies while others tend towards informal ones. But why?

Researchers tend to use family involvement in the firm, such as governance, ownership, and management, as their litmus test for the importance family firms place on non-financial value. The latter encompasses family control, family identity, binding social ties, family emotional attachment, and preservation of the family’s dynasty. Researchers also tend to neglect the areas of family ties and emotional attachment.

IMD’s Alfredo De Massis, together with Josh Wei-Jun and Luis Gomez-Mejia, saw some shortcomings in this and explored a wide spectrum of family businesses through the portal of family firms’ strategic motivation to formalize their CSR strategy (or not). They found that the same non-financial value dimensions may lead to polar strategic choices, and investigated why.

In the case of CSR, these vastly opposing strategic choices were visible in whether or not a firm systematically and openly communicated its CSR activities to external stakeholders. De Massis and colleagues analyzed data from 186 Italian family firms, presenting the results in a paper “Examining Heterogeneous Configurations of Socioemotional Wealth in Family Firms Through the Formalization of Corporate Social Responsibility Strategy,” published by Family Business Review.

It has long been known that family businesses don’t just take financial value into account but also earmark non-financial value when making strategic decisions. Conversely, non-family firms focus on maximizing the firm’s financial value.

Family business owners are, in fact, so in favor of non-financial value that their strategic decisions are driven by it. This helps us to understand why family firms diversify less, are more inclined toward mergers, acquire more similar firms, adopt fewer innovations, invest less in R&D, pollute less, experience more disruptive managerial succession, avoid underpricing for initial public offerings, are less likely to engage in earnings management, and establish more transparent accounting procedures. It also helps explain why they realize greater returns from risk-taking under financial distress.

As is clear, non-financial value is an umbrella term encompassing many areas. De Massis and his colleagues therefore set about using family firms’ efforts to have a corporate social responsibility (CSR) strategy as their litmus paper, finding that a “configurational approach” – that is, the use of several of the aforementioned dimensions to non-financial value – enriches our understanding of just how different family businesses are in terms of their strategic choices.

CSR requires an integrative approach, taking in multiple factors at the same time. It therefore showcases well how multiple dimensions interact to determine a family firm’s attitude to strategy. Specifically in the case of CSR, a firm may choose a formal system in which it tracks and communicates tangible CSR activities (e.g., having a code of conduct, releasing regular CSR reports, and signing written agreements with stakeholders) to external stakeholders over an extended period. Equally, it may choose an informal approach in the form of a private dialog with specific stakeholders.

“Owners and managers of family firms will find the study useful as a reminder to be careful when benchmarking their firms against other firms with similar family characteristics, such as the family’s ownership share of the firm, managerial positions, and board representation.”

Owners and managers of family firms will find the study useful as a reminder to be careful when benchmarking their firms against other firms with similar family characteristics, such as the family’s ownership share of the firm, managerial positions, and board representation.

The authors write: “A meaningful comparison requires the consideration of others’ focus on future dynasty or past legacy; a similarly close family network can be used differently, by focusing on maintaining intrafamily communication within the existing network or on passing such a quality network to the future generation by building a more extensive communication system.”

The authors also found that while formalizing a firm strategy is seen as useful in helping the family sustain the (firm or family) dynasty, most family firms are still motivated to take advantage of the past family legacy (including legal rights, biological ties, and social value) to focus on informal communication with close stakeholders.

The study suggests that external stakeholders might need to adjust their sources of information when evaluating strategic engagement with a family firm by closely examining the configurations of the firm’s family elements before developing communication channels that best fit those configurations.

For instance, although formalized CSR communication is common among large non-family firms, the most common approach among small- and medium-sized family firms was found to be informal communication.

“They rely primarily on the family legacy, including structural power, the in-group network, and social value from the past, to facilitate communication with close family stakeholders,” the authors write. “If external stakeholders aim to further their engagement with these firms, such as increasing their investment or forming a new partnership, their primary information sources may depend less on open communication (such as a formal sustainability report) and more on interpersonal relationships with the controlling family.”

The study is likely to inspire regulators, investors, community organizations, and other stakeholders to monitor and assess why family firms adopt particular strategies, as it will help these different groups better respond to family firms’ needs. In the case of CSR, the work is done for them: family firms that incorporate certain combinations of non-financial value respond to stakeholders’ demands and expectations differently.

Seen more broadly, the study is a reminder of the complex set of forces driving family firms’ strategic behaviors.

March 19, 2025 • by Alfredo De Massis in Family business

Fire, floods, relocation, and a pandemic couldn’t sink Formans, the family-run smoked salmon supplier. Here’s how they stayed afloat....

February 19, 2025 • by Alfredo De Massis, Cristina Bettinelli , Manisha Singal , John Davis in Family business

The survival of family businesses is at stake due to inadequate board management and the difficulties faced by leaders of family businesses in juggling various roles....

February 12, 2025 • by Marleen Dieleman in Family business

Tolaram, the Singapore-headquartered family business, has global interests in logistics, consumer goods, and technology. Family members Mohan Vaswani and Sajen Aswani discuss the company’s values-based system of meritocracy, the family’s move to...

January 31, 2025 • by Alfredo De Massis, Emanuela Rondi, Vittoria Magrelli , Francesco Debellis in Family business

Tradition is defined as the transmission of customs or beliefs from generation to generation. Innovation is the process of changing something established by introducing new methods...

Professor of Entrepreneurship and Family Business

Alfredo De Massis is ranked as the most influential and productive author in the family business research field in the last decade in a recent bibliometric study. De Massis is an IMD Professor of Entrepreneurship and Family Business at IMD where he holds the Wild Group Chair on Family Business and works with other universities worldwide.

Assistant Professor of Business Administration at the Centre for Family Entrepreneurship and Ownership

Assistant Professor of Business Administration at the Centre for Family Entrepreneurship and Ownership, Jönköping International Business School (Sweden). His research focuses on the social issues related to entrepreneurship and family businesses, such as corporate social responsibility (CSR) strategy and individual stakeholders’ well-being. He is currently serving on the editorial review board of Academy of Management Discoveries, Family Business Review, and Journal of Family Business Strategy.

Professor in Management and Entrepreneurship at W. P. Carey School of Business, Arizona State University

Luis Gomez-Mejia is Regents’ Professor in Management and Entrepreneurship at W. P. Carey School of Business, Arizona State University. His research focuses on the relationships of international management, strategic management, executive compensation, and family businesses. He has published more than 250 articles in Academy of Management Journal, Academy of Management Review, Strategic Management Journal, and Administrative Science Quarterly, among others.

Explore first person business intelligence from top minds curated for a global executive audience