Geopolitics in turmoil: How to manage the impact on your workforce

Geopolitical disruption requires a systems thinking approach from CHROs, argue IMD’s Katharina Lange and Simon Evenett....

by Richard Baldwin Published March 24, 2025 in Geopolitics • 10 min read •

During the Cold War, geopolitics was like checkers with two players and simple rules. The game was so straightforward that almost every match ended in a draw. Some countries stood behind the eastern player, the Soviets, while others supported the western player, led by the US. They were two worlds with their own rules, banking systems, supply chains, and economic philosophies.

The Soviet Union’s collapse triggered a new phase of geopolitics that was more like bingo. One main player (the US) called out the numbers while everyone else sat with their bingo cards, trying their best. Some won, others didn’t. Many people didn’t like the game but could do little about it. The US dominated almost every sphere: economic, military, security, intelligence, cultural, and financial. The dollar was the linchpin of the world financial system.

Today, it’s a lot more complicated. The game has become something akin to 3D chess with about 150 players at the table: some play when the pieces are on the top plane, some when they’re on the bottom plane, others all the time, and some never play. The rules are unclear, in flux, and different for different regions and domains. The global landscape has never been more confusing and challenging to navigate.

To understand why this is happening and how businesses might respond, it helps to consider what has been driving these changes. Spoiler alert: it’s not just President Donald Trump.

In 1990, the G7 industrialized countries controlled about two-thirds of world GDP and all the rules, institutions, and systems that went with it, with the US as leader. Fast forward to 2022, and the G7’s share of global GDP had plummeted to just 44%. While the US share has held steady at around 25%, other G7 members saw their GDP shares drop. Meanwhile, China experienced a miraculous rise from 2% to 17%. While impressive, this isn’t enough for dominance. Even when China eventually surpasses the US economy, it won’t achieve the dominance the G7 once enjoyed. For starters, it doesn’t have a coalition of massive economies following its lead.

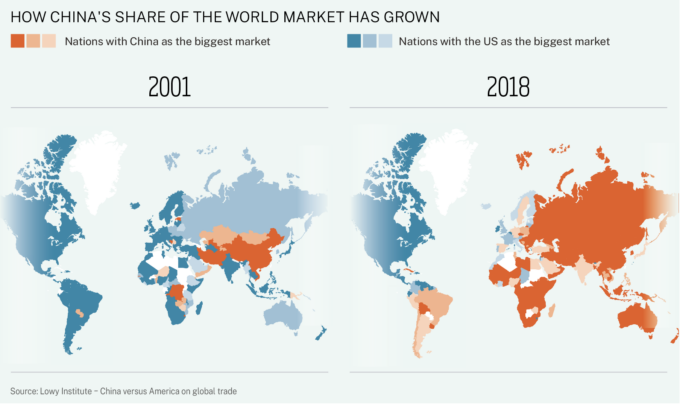

These shifting sands have played out in market influence. In 2001, more countries counted the US as their largest market compared with China. However, by 2018, China had become the dominant buyer for many nations. This shift reflects China’s waxing and America’s waning leverage.

China’s rise has coincided with America’s gradual but deliberate retreat as the hegemonic bingo caller on the world stage. One root cause was the US mismanagement of the technology and globalization shocks that affected all advanced economies in the 1990s and 2000s. This fumble led to a backlash among the US middle classes, with politicians from the left and the right blaming foreigners rather than policymakers. The narrative has resonated among voters across the States. There is a popular consensus that the US should focus on domestic affairs: “Make America Great Again” and “America First”, to coin a phrase or two.

Other factors are at play. For example, life expectancy in the US is lower than in China and other major economies. But perhaps most telling of all is the death of the American Dream. Social mobility has fallen behind many other advanced economies, including European nations. While 90% of people born in the 1940s earned more than their parents by age 30, less than half of those born in the 1980s achieve the same milestone. A common narrative is that many Americans can’t afford to buy the houses they grew up in, let alone accomplish the traditional American Dream of buying something bigger and better. This frustrating reality – in the works since Ronald Reagan’s time as president – has stoked considerable anger.

While the US has turned its focus inward in some areas, it has maintained superpower status in two crucial domains. First, it continues to dominate global financial markets and banking. The dollar’s role as the world’s primary currency in debt markets and international trade invoicing gives America extraordinary leverage. Even more important is the central place of US banks in international payments and the US government’s weaponization of that dominance. This creates an intriguing global economic power structure: a former global hegemon that wields control in the financial sphere yet has consciously stepped back from its role as hegemon – or even leader of the G7 – in the broader domain. At the same time, the US remains the dominant force in military spending. This combination of financial and military muscle, alongside its retreat from global economic leadership, creates a complex and puzzling situation.

As the US has eased back, China has stepped up. China’s extraordinary rise to global manufacturing dominance is not as widely recognized as it should be. Beginning at 5% in 1995, China’s share of global output has soared to 35% today. China overtook Germany in the late 1990s, Japan in the early 2000s, and the US in the late 2000s. Since surpassing the US, China’s share of global manufacturing output has doubled again. This ascent in manufacturing happened so quickly that policymakers in G7 countries were caught off guard, failing until recently to fully grasp the implications. China’s share now exceeds the combined output of the following nine largest producers.

For decades, Chinese growth was nothing short of miraculous. Following the death of Mao Zedong in the mid-1970s and the leadership transition to Deng Xiaoping, China experienced a boom that transformed its economy and society. During at least two decades of this period, average annual growth exceeded 10%. At such a rapid rate of expansion, the income of an average Chinese worker would double more than five times over a typical working life. However, since 2007, Chinese economic growth has decelerated markedly. Today, growth hovers around 5% and forecasts suggest it could remain at this level or even decline further. In Western economies, a consistent 5% growth rate would be cause for celebration, but it might seem underwhelming for a population accustomed to three or four decades of miraculous growth.

The slowdown raises questions for the Central Communist Party (CCP). It has exercised an increasingly tight grip on the economy and society in recent years, consolidating control over key sectors, imposing stricter regulations on businesses, and tightening social oversight. Are these two trends a coincidence or a strategic recalibration aimed at maintaining stability in a slower-growth environment?

A common narrative about the collapse of the Soviet Union posits that citizens were willing to support their government as long as living standards were rising, as they did during the 1950s, 60s, and 70s. When growth stagnated and the comparative success of Western economies became more evident, popular support for the regime waned. Could China face a similar challenge?

For most of the three decades of miraculous growth, China was a navel gazer – with policymakers focused on industrialization and improving the economic well-being of its citizens. This began to change during the 2010s. The launch of the Belt and Road Initiative (BRI) in 2013 was pivotal. By offering substantial investments in infrastructure projects, it supported development in several developing countries and helped to create a more interconnected global economy. While the initiative has faced criticism – most notably concerns about over-indebtedness and the long-term viability of some projects – it has largely been a win-win endeavor. Many countries in Asia, Africa, and Latin America have benefited from improved infrastructure that facilitates trade, investment, and integration into the global economy. In return, China has bolstered its economic ties and influence, creating connections that linked developing nations more closely to its markets.

The move represented a significant change in the global economic and geopolitical landscape, as China positioned itself not only as an economic powerhouse but as a key partner for developing nations.

China’s outward focus took a more assertive turn in the 2010s as it began to shift from economic engagement to military and territorial strategies. A symbolic step was the construction and militarization of artificial islands in the South China Sea. In 2018, the removal of presidential term limits meant President Xi Jinping could remain in office indefinitely, a shift toward more centralized authority within China’s political system. The Hong Kong National Security Law was passed in 2020, undermining the “one country, two systems” framework many believed would preserve Hong Kong’s political and legal autonomy. More recently, kinetic actions involving the Chinese Coast Guard and vessels from neighboring countries have heightened tensions in the South China Sea. This holds global significance, particularly for Europe, as a substantial portion of its trade with East Asia flows through these waters.

China’s more restrained approach earned it the image of a panda, but now it resembles more of a dragon.

Geopolitics has become messier for business to navigate because the economic order has changed. As the US has recoiled from global economic leadership and turned inward, a power vacuum has emerged, part of which China has filled. The US remains the superpower in all things financial and unrivaled in military capabilities, but China has become the hegemon of global trade. No one nation is calling out the bingo numbers anymore. This lack of cohesion – what the political scientist Ian Bremmer calls a “G-Zero world” – means that many countries exercise significant power within their regions in a confusing game of 3D chess: Russia and Turkey in the Near East; Saudi Arabia, Israel, and Iran in the Middle East; and China in the Far East.

This situation has made life much more complicated for businesses. Many are ill-equipped to cope with a multipolar world, but most must get up to speed quickly. Here are five points to consider:

President Trump’s approach to foreign and economic policy has shaken things up more aggressively than previous US administrations, and the potential implications for business worldwide will likely be significant in the near term. However, the move toward a more chaotic geopolitical landscape, shaped by the trends outlined here, has been in train for many years and will continue long after Trump departs the White House.

The key battleground will be in the manufacturing sector. China’s rise to dominance will continue to pose considerable challenges for other governments and companies seeking to manage resources, supply chains, labor, consumer demand, and the fallout of the burgeoning Trump-led trade war. Services will likely be saved from the worst of this unless they touch on areas such as infrastructure with national security aspects (e.g., 5G) or privacy issues (e.g., TikTok).

To anticipate changes and adjust, organizations must have the resources to monitor events and translate what they mean for the business. For example, this could involve adding talent in-house supported by external specialists.

Clear processes, roles, and responsibilities will improve your organization’s ability to respond or change tack effectively when necessary. This decision-making capability must be clearly defined and communicated from the boardroom to the shop floor.

Scenario planning, tailored to the different areas of the business, will offer a sense of security in this age of uncertainty. You may not ever need to download these plans, but the collective process of creating them will establish an environment and culture of readiness and help uncover weaknesses and unseen risks while reassuring investors and other stakeholders.

The June 2025 edition of I by IMD magazine will focus on the ramifications of a turbulent geopolitical and economic global landscape for leaders and their organizations.

Professor of International Economics at IMD

Richard Baldwin is Professor of International Economics at IMD and Editor-in-Chief of VoxEU.org since he founded it in June 2007. He was President/Director of CEPR (2014-2018), a visiting professor at many universities, including MIT, Oxford, and EPFL, and a long-time professor of international economics at the Graduate Institute in Geneva. Richard is an expert in global economic policy and theory, specializing in international trade.

April 21, 2025 • by Simon J. Evenett, Katharina Lange in Geopolitics

Geopolitical disruption requires a systems thinking approach from CHROs, argue IMD’s Katharina Lange and Simon Evenett....

April 3, 2025 • by Arturo Bris in Geopolitics

US President Donald Trump's brazen assault on the global trade order will disrupt international capital flows, affecting everything from supply chains to labor mobility. Here's a checklist for reconsidering corporate strategy....

April 3, 2025 • by Simon J. Evenett in Geopolitics

The United States has finally abandoned traditional trade diplomacy in favor of a formula-based tariff regime that penalizes bilateral trade surpluses. For firms with cross-border supply chains, the implications extend far beyond...

February 28, 2025 • by Mark J. Greeven, Sophie Liu in Geopolitics

How China’s journey of self-reliance, innovation, and strategic resilience under “Made in China 2025” continues to redefine its global role amid ongoing geopolitical tensions and renewed policy challenges....

Explore first person business intelligence from top minds curated for a global executive audience