test 100

Uncategorized test 100 Published May 8, 2025 in Uncategorized • 1 min read DownloadSave Uncategorized test 100 Published May 8, 2025 in Uncategorized • 1 min read DownloadSave Lorem ipsum dolor sit...

by Mark J. Greeven, Sophie Liu Published April 14, 2025 in Asian hub • 6 min read

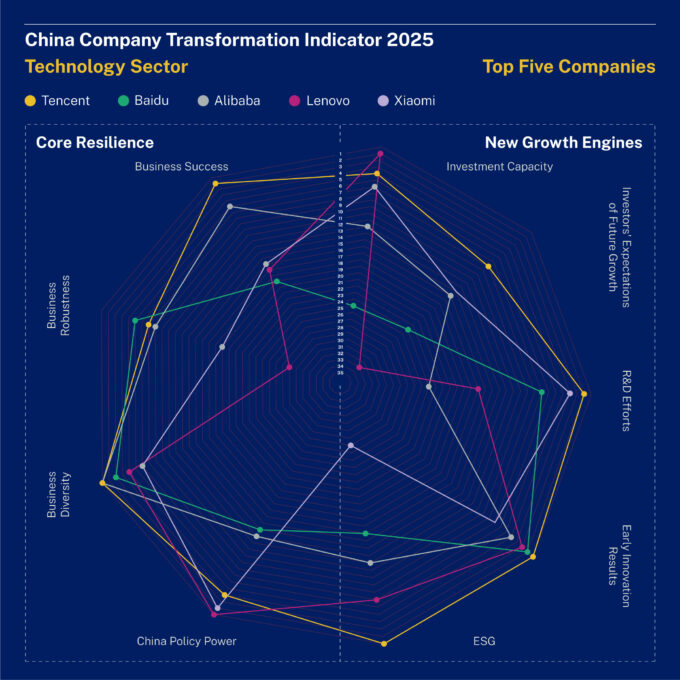

Despite ongoing trade tensions and regulatory adjustments, the 2025 China Company Transformation Indicator (CCTI) shows that AI-driven integration and strategic diversification are key to continued success for leading tech companies.

The technology sector continued its relentless momentum of recent years, solidifying its status as a global innovation powerhouse despite intensifying geopolitical and economic complexities. Breakthroughs in artificial intelligence, digital infrastructure, and next-generation chip development have driven new waves of growth, while hardware and semiconductor firms tackled strategic challenges to accelerate China’s push for self-reliance in critical technologies. AI-driven solutions are now embedded across industries, catalyzing industrial modernization and economic transformation.

The 2025 CCTI rankings reveal notable shifts in market leadership, with companies that have prioritized AI integration, digital ecosystem expansion, and investment in next-generation technologies securing a competitive edge. Meanwhile, firms that have struggled with regulatory headwinds, intensifying competition, or which are slower to adapt to emerging technologies have lost ground.

A full description of each key factor is in the Methodology section of the white paper.

Category | Key Factors |

|---|---|

| Core Resilience | Business Success |

| Business Robustness | |

| Business Diversity | |

| China Policy Power | |

| New Growth Engines | Investment Capacity |

| Investors’ Expectations of Future Growth | |

| R&D Efforts | |

| Early Innovation Results | |

| Environmental, Social, and Governance |

Tencent maintains its top ranking in the 2025 CCTI, setting the benchmark in Early Innovation Results (first), Business Diversity (first), and R&D Efforts (second). As one of the world’s most influential technology conglomerates, Tencent continues to dominate social media, gaming, cloud computing, fintech, and AI-driven enterprise solutions. With a highly diversified portfolio and strategic investments in next-generation technologies, Tencent is not just shaping China’s technological ecosystem, it is driving global digital transformation.

Tencent’s business is on a strong recovery path, with WeChat live-streaming commercialization, mini-games, AI technology, and cloud expansion emerging as key growth drivers. After navigating regulatory and market challenges in 2022, the company rebounded in 2023 with a significant profit surge and strategic refocusing. Its Cloud & Smart Industries Group has become a foundational pillar, providing critical support across Tencent’s ecosystem and driving synergies between AI, enterprise services, and digital transformation.

Tencent’s RMB 64bn R&D investment in 2023, up from RMB 61.4bn the previous year, is the foundation of its leadership in artificial intelligence, cloud computing, and gaming innovation. A key driver of Tencent’s AI strategy is its proprietary large language model Hunyuan By May 2024, it had already been piloted across more than 600 internal business units and application scenarios, optimizing gaming, fintech, advertising, and enterprise AI solutions, creating an AI-driven ecosystem that enhances both product differentiation and the potential for long-term monetization.

Baidu’s R&D investments helped it secure the second spot behind Tencent as it climbed from fifth in 2024. This boost was driven by its leadership in AI-driven solutions, expansion in autonomous driving, and continued advancements in cloud-based AI services, and contributed to its success in the 2025 CCTI.

Xiaomi surged 10 places to fifth in 2025 as a result of its leadership in smartphones, successful expansion into electric vehicles (EVs), and development of the world’s largest AI-powered Internet of Things (IoT) ecosystem. Xiaomi’s high Business Diversity ranking (seventh) reflects its ability to leverage core technological expertise to scale into high-growth sectors. The launch of its SU7 electric vehicle in March 2024 marked a bold entry into the high-growth new energy vehicles (NEV) market. By Q3 2024, Xiaomi’s electric vehicles (EV) business had already generated RMB 9.7bn in revenue and an impressive gross profit margin of 17.1%.

At the core of Xiaomi’s evolution is its relentless focus on R&D, which secured a fourth ranking in R&D Efforts. In 2023 alone, Xiaomi invested RMB 19.1bn in R&D, a 19.2% year-on-year increase, with more than 53% of its workforce – or 17,800 employees – dedicated to expanding Xiaomi’s position in AI, IoT, and smart hardware development.

iFlytek remains China’s leading AI and speech technology company, ranking tenth in 2025 CCTI with notable strengths in Early Innovation Results (sixth), Business Diversity (16th), and R&D Efforts (15th). Specializing in voice recognition, speech synthesis, and natural language processing (NLP), iFlytek has expanded AI applications across education, healthcare, and enterprise automation, positioning itself as a key player in China’s AI-driven digital transformation.

DeepSeek’s global debut makes waves with its international-local AI approach

DeepSeek emerged on the global AI scene in early 2024 with DeepSeek Coder, followed by their general-purpose LLM series. DeepSeek was not assessed for the 2025 CCTI.

Founded in 2023, the Hangzhou-based company competes with both Chinese and global AI organizations.

DeepSeek offered several advantages – some tailored to the Chinese market – over competitors like ChatGPT:

As of February 5, 2025, the DeepSeek AI app has been downloaded more than 21.66 million times worldwide across Google Play and App Store.

Companies that balance technological ambition with strategic diversification and regulatory alignment will lead China's next wave of digital transformation.

The 2025 CCTI rankings confirm that AI-driven innovation and strategic diversification will continue to define success in China’s tech sector. Leading companies are expanding beyond traditional boundaries, integrating AI across business functions, and investing heavily in R&D to drive long-term growth. Semiconductor self-sufficiency remains a national priority, creating opportunities for hardware innovators.

As competition intensifies, companies must balance technological ambition with regulatory compliance, particularly in data security and algorithmic governance. Those that successfully navigate these challenges while maintaining innovation momentum will emerge as the architects of new China’s digital future and increasingly influential players on the global technology stage.

Discover the full results of the IMD China Company Transformation Indicator 2025.

Professor of Management Innovation, Dean of IMD Asia, Chief Executive of IMD China

Mark Greeven is Professor of Management Innovation and Strategy and Dean of Asia at IMD, where he co-directs the Building Digital Ecosystems program and the Strategy for Future Readiness program. Drawing on two decades of experience in research, teaching, and consulting in China, he explores how to organize innovation in a turbulent world. Greeven is responsible for the school’s activities and outreach across China and is a founding member of the Business Ecosystem Alliance. He is ranked on the 2023 Thinkers50 list of global management thinkers.

Research Associate, IMD China

Sophie Liu is a Research Associate at IMD China. Her work focuses on business and company transformation within China’s dynamic market landscape, as well as the development of Generative AI in the region, with a particular emphasis on the Asian market. Sophie holds a Master of Science in Finance from the Chinese University of Hong Kong and a Bachelor’s degree in engineering from the National University of Singapore. Prior to joining IMD, she gained valuable experience in equity investment in Hong Kong and the banking industry in Singapore, bringing a well-rounded perspective to her research.

1 min ago • by Sarah E. Toms in Asian hub

Uncategorized test 100 Published May 8, 2025 in Uncategorized • 1 min read DownloadSave Uncategorized test 100 Published May 8, 2025 in Uncategorized • 1 min read DownloadSave Lorem ipsum dolor sit...

April 14, 2025 • by Mark J. Greeven, Sophie Liu in Asian hub

China’s pharmaceutical sector is undergoing a major transformation, driven by innovation, demographic shifts, and bold regulatory reforms. As urbanization and an aging population fuel demand, top companies are leveraging R&D strength and...

April 14, 2025 • by Mark J. Greeven, Sophie Liu in Asian hub

Explore how China’s apparel sector, especially sportswear, continues to thrive in 2025, driven by innovation, strong R&D efforts, and digital engagement. Learn about key players like ANTA, Bosideng, and Lululemon, as they...

July 18, 2024 • by Mark J. Greeven, Sophie Liu in Asian hub

The New Materials sector in China is currently dominated by foreign multinational companies, but the Chinese government’s strategic focus on the sector is encouraging home-grown challengers to invest in research and development...

Explore first person business intelligence from top minds curated for a global executive audience