Free up sustainability reporting to boost the triple bottom line

Future-proof your organization

Equip yourself with the expertise to embed forward-thinking strategies into your organization, helping you anticipate market shifts, reduce risk, and unlock new opportunities for growth.

Sustainability lacks benchmarks and transparency

Lack of universal comparability

The Global Reporting Initiative (GRI) has strived to improve sustainability reporting by specifying the information that all firms must provide on their economic, environmental and social performance. These guidelines are followed by over 70% of the world’s largest firms, but they also allow for exceptions. A firm can claim that a required disclosure does not apply to it, or that the information requested is confidential, legally prohibited or simply unavailable. These exceptions make it hard to compare sustainability performance between firms, or over time for any company. Furthermore, since sustainability reports are a primary source for sustainability indices, such exceptions also limit the value of these indices.Lack of transparency

Another challenge for sustainability reporting is transparency. Many of the indicators are easy to game. For example, a firm can report high local community engagement by having token programs in all of its operations, even if these are not effective. Companies have tried to address this by employing external auditors. However, auditors can only certify the number, not the effectiveness, of these programs.

Misaligned with internal needs

But the biggest problem with sustainability reports is that they are often misaligned with company priorities. Achieving success for the TBL requires a healthy balance between social, environmental and economic performance. The measures for each, and how they should be weighted, varies from firm to firm. Consider the case of Dr Reddy’s, a leading Indian pharmaceutical firm that followed George Merck’s dictum, “Medicine is for people, profits follow”. The firm’s leadership had the opportunity to create a low-cost pill for treating heart disease by combining four proven ingredients. The plan was to offer the pill for a total treatment cost of less than $25 a year that even a labourer earning $2 a day could afford. This pill had the potential to dramatically reduce death and disability from cardiovascular disease, the number one killer in India. However, the costs associated with developing and marketing the product would be significant. The economic burden in the short and medium term would be severe, though this might change in the long term if optimistic assumptions panned out. Other sustainability champions have faced similar dilemmas where social, environmental or economic needs tug at each other. How companies manage their sustainability dilemmas, or fail to do so, is far more illustrative of their commitment to the TBL than any sustainability report. Companies like Unilever have provided rich narratives on how they translate their vision for environmental and social performance into concrete long-term goals; how they convert these goals into short and medium-term targets at the business level; how they monitor performance against all three bottom lines; and, most importantly, how they coach managers to make difficult trade-offs. These examples teach us that, to unlock the real benefits of sustainability reporting, we must incentivize companies to share their unique approaches to boosting their TBL, rather than constrain or distract them with an externally imposed structure. There is precedence for this.Don’t put the cart before the horse

Consider the history of financial reporting. The publishing of annual reports predates any external requirement. The first annual report was published by US Steel in 1903. The guiding principle was to represent the company’s financial situation to its shareholders in the best way possible. It was the company’s story. External standards, first set successfully by the Accounting Principles Board (APB) and then by the Financial Accounting Standards Board (FASB), came much later. In the case of sustainability reporting, we have reversed this process. External standards and reporting formats have emerged without giving companies the chance to tell their unique stories based on the metrics and processes that they use to manage their distinct TBL dilemmas. Unless we align what is monitored and valued inside a firm with what is broadcast externally, sustainability reporting will remain little more than a public relations exercise.

IMD business school is an independent academic institute with close ties to business and a strong focus on impact. Through our world-leading Executive Education, Master of Business Administration (MBA), Executive MBA, and Solutions for Organizations we help leaders and policy-makers navigate complexity and change. Here at IMD, you can develop your strategic thinking skills by learning alongside senior leaders from around the world – set against the inspiring backdrop of the Swiss Alps.

Research Information & Knowledge Hub for additional information on IMD publications

Executive Programs

Upcoming Events

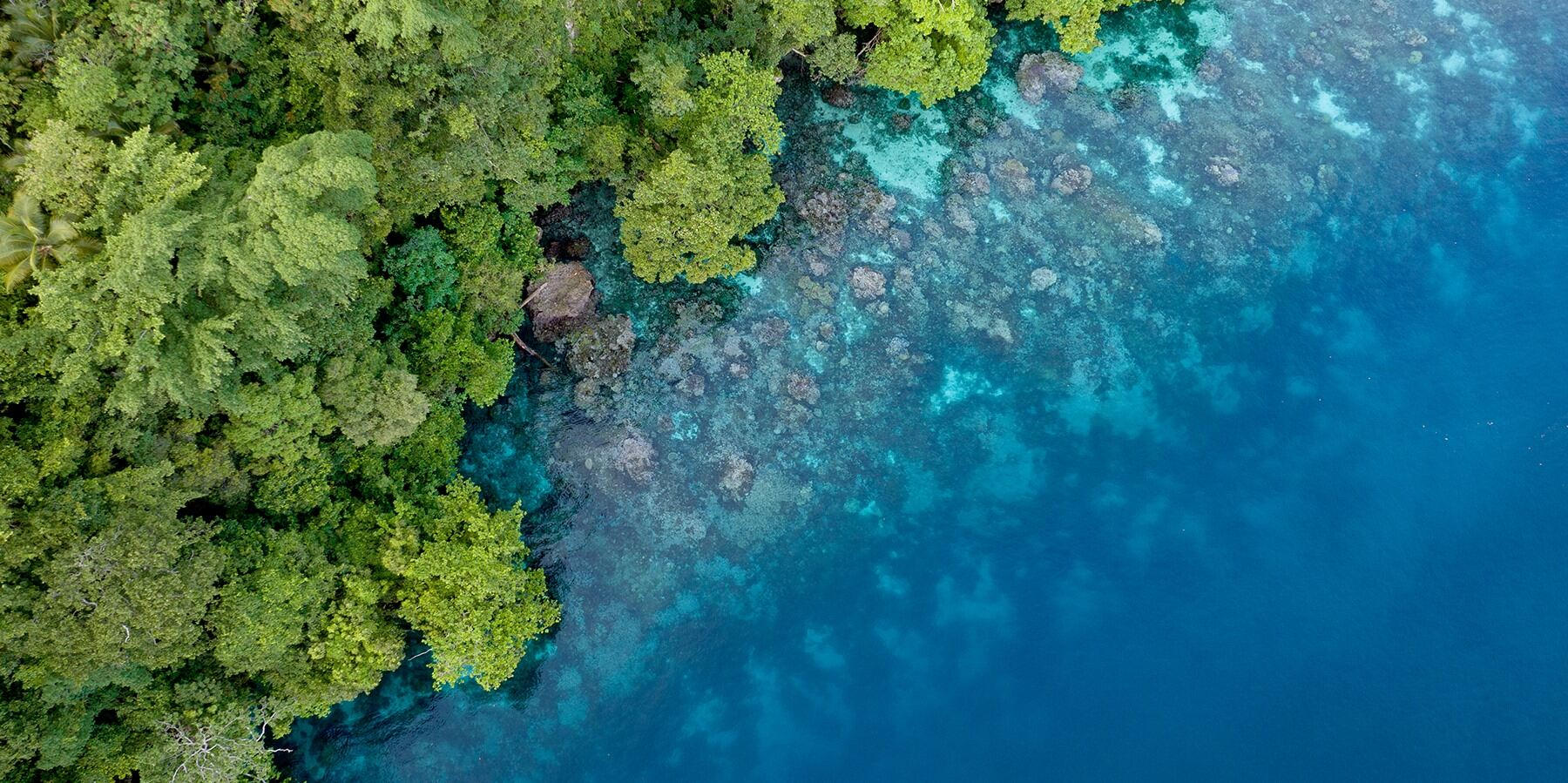

Businesses can showcase their commitments to nature and sustainability by using new voluntary biodiversity credits to invest in conservation actions that can be measured.

Business leaders must master the art of building strategies that take account of partisan divides over net-zero goals while progressing the interests of their company and society.

A guide to help businesses navigate the rapidly evolving voluntary biodiversity credit (VBC) markets.

This guide aims to help businesses navigate the rapidly evolving voluntary biodiversity credit (VBC) markets and decide whether and how to engage in VBCs. It is intended for companies that want to help halt biodiversity loss or restore and regener...

Rethinking sustainability at Bayer, Daniel Schneiders shows how shifting team ownership and decision-making drives lasting impact across the company.

Climate risk is financial risk and delaying action only increases costs. Despite backlash, the shift to a cleaner energy future must accelerate.

Future-ready organizations that focus on the energy transition and accelerate along with it will reap the benefits.

The Tropical Landscapes Finance Facility Sustainability Bond (TLFF I) was initially celebrated as a best-in-class example of sustainable finance. Issued in 2018, this $95 million financial instrument aimed to create a promising future: sustainable...

ABB CEO Morten Wierod on leaner cleaner strategy, electrification, automation, robotics, AI, digital transformation, sustainability, leadership.

ABB CEO Morten Wierod on leaner cleaner strategy, electrification, automation, robotics, AI, digital transformation, sustainability, leadership.

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

IMD white paper, 23 September 2025

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

in I by IMD

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications